Photo credit: Andriy Onyfriyenko, gettyimages

Introduction

The functionality of energy complexes is arguably considered as the lifeline of any economy globally as it drives the performance of different economic nodes and hubs. Along this line, different nations pay apt attention to the dynamics of their energy mix and complexes, to ensure that they actively contribute to economic growth. Also, with the increased attention on the environmental impact of energy systems and its consequent economic cost, there is a strong disposition globally towards “greening” energy systems, in line with the stipulations of the Paris Agreement of 2015. It is on this note that renewable energy solutions with limited environmental impact are highly desirable to be incorporated into energy mixes, as an energy transition strategy.

Currently, one of the highly desirable renewable energy solutions is green hydrogen, a solution that has capacity to foster optimal energy utilization systems performance while also reducing environmental impact. Particularly, the vital role of green hydrogen in driving upward economic performance is well evident in countries with huge production capacity. These renewable-rich countries that can facilitate an optimal green hydrogen economy (especially countries in the global south with enormous solar energy, high wind intensity and access to huge water bodies) therefore have the opportunity to strengthen their energy security, reduce their vulnerability to global energy market shocks and play a major role in the emerging global green hydrogen market and economy.

The role of Green Hydrogen in Economic Revitalization of Nigeria

Currently, projections from International Renewable Energy Agency put forward that green hydrogen would play a key role in achieving the 1.5oC climate goal by 2050, especially considering its application in hard-to-abate sectors, aviation and maritime transportation sector and as an energy carrier in various industrial applications. However, with a projected global production capacity to 492 million tonnes by 2050 as against 95 million tonnes produced in 2022, it is evident that green hydrogen production (and its consequent economy) has huge potential for expansion into future decades. Therefore, there is a huge opportunity for renewable-rich countries (Nigeria strongly inclusive) to tap into an emerging green hydrogen economy that can drive its economic performance.

In Nigeria specifically, there are different nodes of application where green hydrogen can drive economic growth. Firstly, there is the low-hanging fruit of its use as feedstock in hard-to-abate industries such as iron, chemical and steel industries, as a decarbonization solution to meet corporate standards, international trade regulations (e.g., the European Union’s Carbon Budget Adjustment Mechanism); this is very important for Nigerian industries that seek to achieve significant export to markets with high decarbonization standards.

Secondly, in view of the fact that Nigeria has huge capacity to increase its agricultural production, the country stands to benefit from the extensive storage systems of green hydrogen. In this case, the conversion of green hydrogen to other derivatives such as methanol, synthetic fuels and ammonia can provide intermediates, which creates a viable link between the energy and agricultural sector, that leads to employment opportunities and consequent economic growth. In similar vein, the functionality of a green hydrogen economy is hinged on an effective backward linkage, with upstream suppliers of technologies such as solar PVs, wind energy installations, electrolyzers amongst other equipments. On this note, it is put forward that a vibrant green hydrogen economy would create sub-economic nodes where businesses can spin off, research and development can thrive, all leading to economic growth.

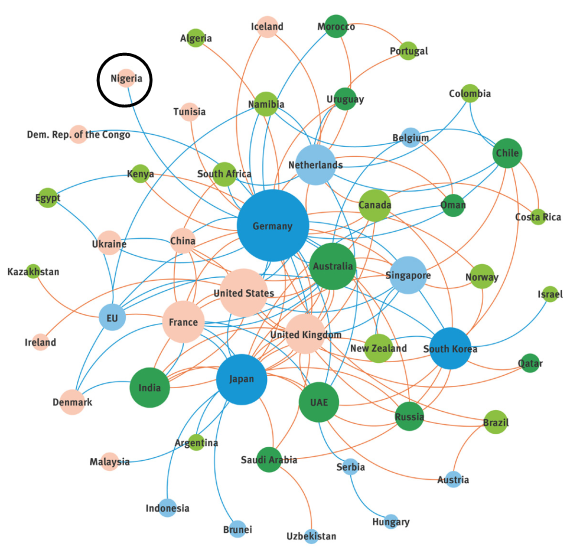

In lieu of the fact that global green hydrogen economy is projected to increase with renewable-rich countries playing a key role as exporting countries, there exists the possibility of drawing foreign direct investments in these countries. For instance, in the case of export driven green hydrogen countries (which are mainly renewable-rich developing countries), there is bound to be influx of investment to establish needed infrastructure for the production of green hydrogen for export. A huge network of interconnected lines of import-export partnership between countries is shown below, where Nigeria is found to have such partnership with Germany, one of the countries identified to be a key player in global hydrogen economy, posited to import about 70% of its hydrogen demand. With this partnership, there is bound to be a strong possibility of influx of investment that would position the country to delve into green industrialization and be better ready to actualize her sustainability goals.

Current global hydrogen partnership networks. Source: IRENA (2023)

How can Nigeria position itself to benefit from this evolving green hydrogen economy

In spite of the opportunities offered by green hydrogen economy to Nigeria’s economic growth, its actualization is not a walk in the park, neither will it be implemented in a business-as-usual scenario. This difficulty is largely hinged on the fact that green hydrogen lacks cost competitiveness with other forms of hydrogen (especially grey and blue hydrogen). Currently, according to IRENA (2023), green hydrogen production is considered to be 3 – 6 times higher than the production cost of grey hydrogen that is estimated at 1 – 2 USD per kg even under optimal production conditions.

With this in mind, a vital step that Nigeria would need to take is to drive down the cost of production so as to position the country as a main competitor in the evolving global green hydrogen economy. In this case, Nigeria needs to take steps to domesticate the manufacturing of core technologies such as solar PV cells, electrolyzers and wind turbines by encouraging locally inclined research and development, that would bolster local manufacturing of these technologies. This is not expected to be an easy feat as technology transfer is usually complicated along international lines however, the government would need to be intentional about it. Signing of export partnership should include clauses of technology transfer and local content requirements.

While cost of production is being driven down, the government needs to focus on stimulating market for green goods within its ranks such as public procurement and activities, which would set a precedence for private sector to follow. This preference for green goods should complement subsidies granted to players in the sector, thereby acting as a market shaper that would mold the nation’s green hydrogen economy into one that supports economic growth. Further, green goods produced from value chain of green hydrogen inclined towards local manufacturing systems can be prioritized over those imported. Also, price premiums can be placed on green goods being purchased via public procurements.

In summary, there needs to be policy designed to prioritize domestic consumption of green hydrogen and its derivatives before exports; this is very vital considering the negative economic impact being experienced by Nigerian currently, where it prioritizes exports over domestic consumption in its fossil fuel economy. In other words, the country (particularly its policymakers) needs to see green hydrogen economy as one that needs to be domesticated first, before being exported for foreign exchange, as a means to drive economic growth in the country.