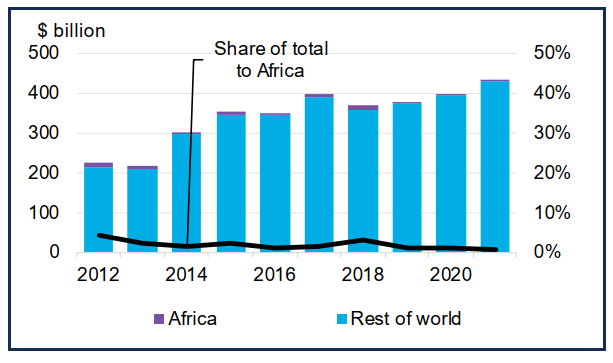

A recent report released by International Energy Agency shows that Africa gets insignificant funding for its clean energy transition. Specifically, the African Development Bank reports that Africa gets less than 2% of global investment in clean energy, highlighting the dire financing limitation facing energy transition in the continent. In fact, it is further reported by Bloomberg NEF that in 2021, the African continent received only 0.6% (USD 2.6 billion) of the global USD 434 billion renewable energy spending.

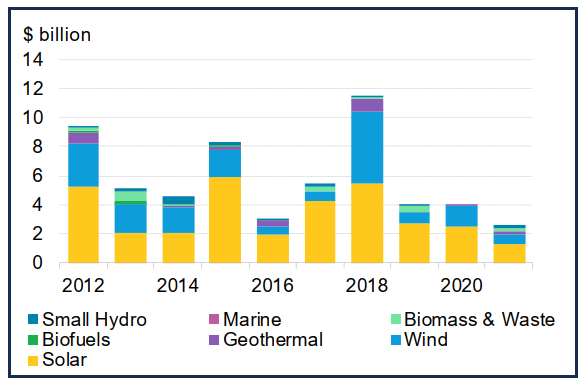

Worst still, this funding is inconsistent with peak funding recorded between 2012 and 2018, hitting above USD 9 billion, when specific projects attained closure in Kenya and South Africa. However, since then, funding has stayed below USD 4 billion per annum, with most of these fundings concentrated in a handful of nations such as Egypt, South Africa, Kenya and Namibia, with nations accounting for about three-quarter of funding to the continent. As expected, solar energy receives the most funding due to the huge solar potential of the continent, accounting for about 57% of renewable energy investment between 2010 – 2021.

This depicts a chaotic flow of clean energy investments into the continent, preventing comprehensive energy transition, carbon emission reduction and limiting global temperature rise to 1.5oC. It is apparent that the funds flow to economies that private sector believe are economically beneficial to their investments, prioritizing profitability over impact. With this reality in mind, advocacy for clean energy investment has to be retooled and reimagined. For instance, instead for asking for more funding to the continent, advocacies should be directed at governments to make their respective economies stable and attractive, while also reducing systemic and projects risks, so as to make these countries suitable for inflow of funding for clean energy investment.

Further, it is important to highlight that innovative financing mechanisms that would suit the realities of the African continent needs to be explored. This is especially as the current flow of funding would forestall the targeted clean energy investment of USD 200 billion required in Africa by 2030. Funding mechanisms such as concessional funding, blended finance structure (which adjusts project risks), institutionalization of carbon markets (supporting revenue flow for projects), venture capital, private equity, debt provision via sustainable bond market, pension funds and other green finance facilities should become popular within the continent.

With this mind, players within Africa’s energy transition ecosystem should begin to engage with the right stakeholders in their countries, so as to catalyze increased funding for clean energy investment, thereby ensuring that comprehensive energy transition in Africa comes to fruition.